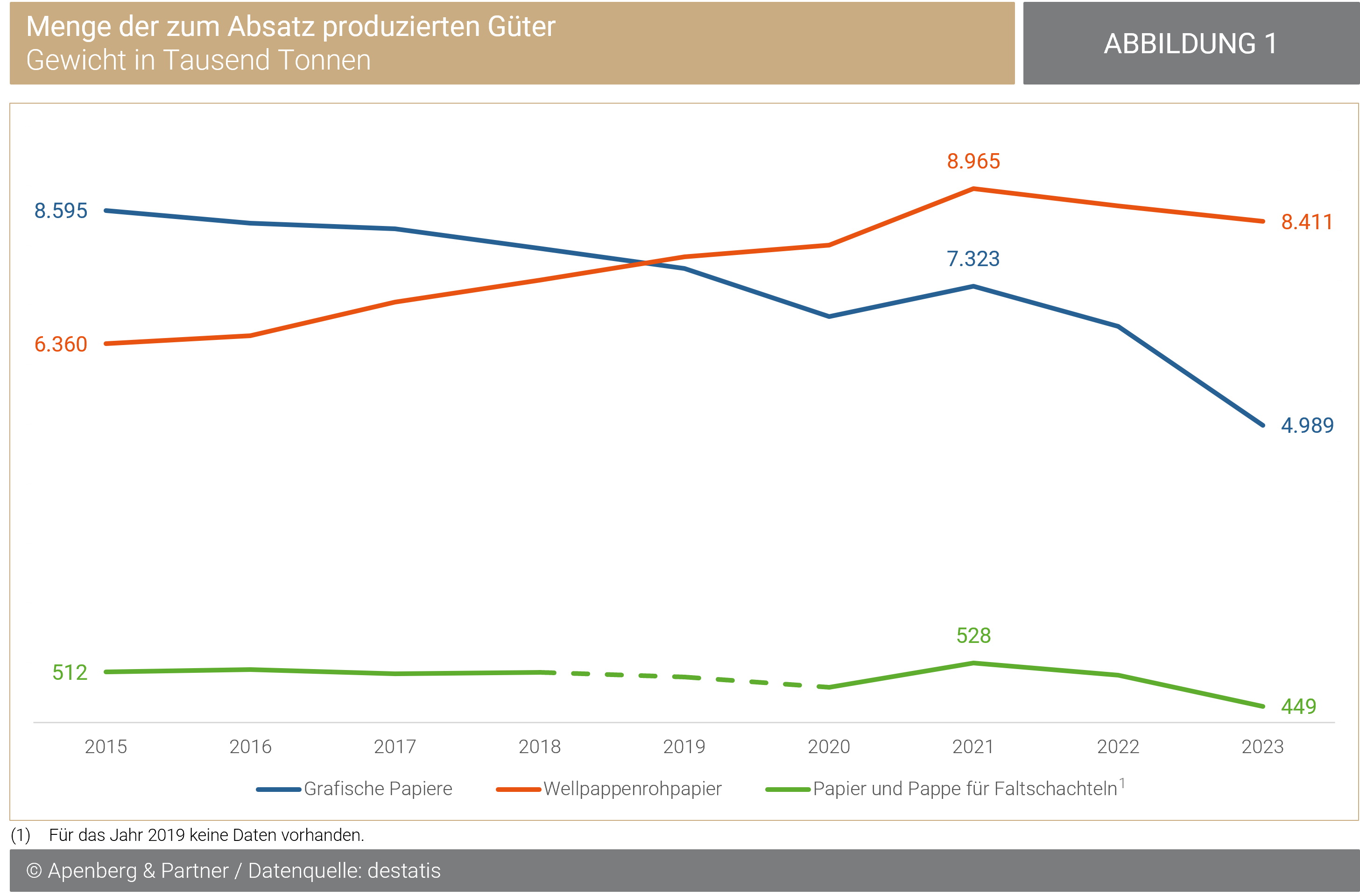

The amount of paper produced for sale by paper mills in Germany has been decreasing since 2021. This trend is evident in corrugated board paper, graphic paper, as well as papers and boards for folding boxes.

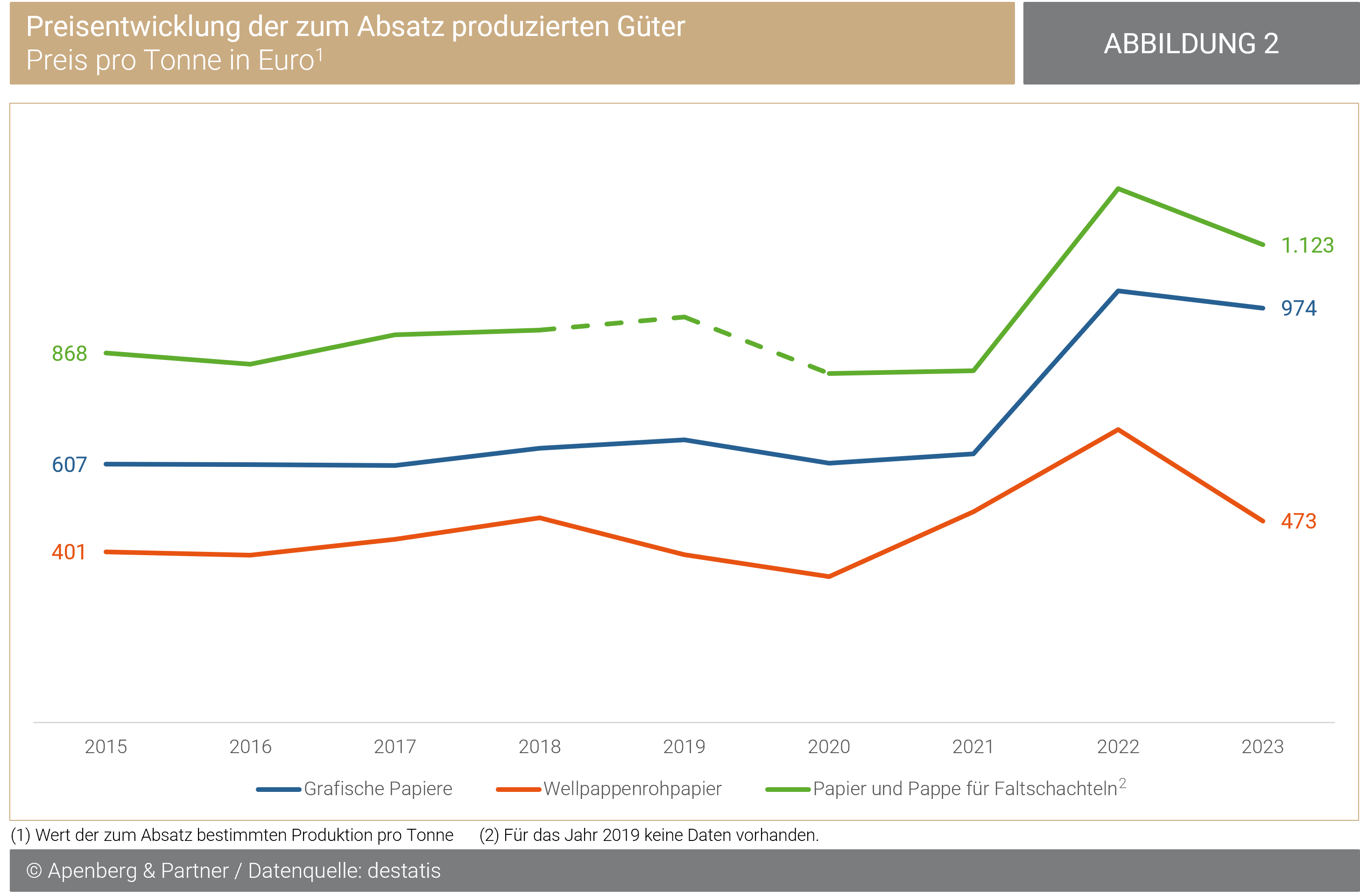

The prices for paper (represented here by the value per ton of paper produced for sale) have decreased in 2023 compared to 2022. In some cases, such as for corrugated board paper, the decline is significant, bringing the price back to the 2021 level. The price for graphic papers has only slightly decreased compared to 2022 (-4%). This is partly due to the price of uncoated paper rising compared to 2022, while the price of all other paper types has decreased.

Graphic Paper Sales Have Been Declining Since 2015

In 2015, nearly 8.6 million tons of graphic paper (blue graph) were sold, but by 2023, this number had dropped to just under 5.0 million tons (-41%). Particularly between 2021 and 2023, sales have decreased by around one-third, from 7.3 million tons to 5.0 million tons.

Sales of corrugated board paper increased significantly from 2015 to 2021 (+40%). However, in the following years (2022 and 2023), sales have slightly decreased (-6%).

From 2015 to 2021, sales of corrugated board paper (red graph) rose from approximately 6.4 million tons by 2.6 million tons to nearly 9.0 million tons. Since 2021, sales have decreased by about 0.5 million tons to 9.4 million tons in 2023.

Sales of Paper and Board for Folding Boxes Have Been Declining Since 2021

Sales of paper and board for folding boxes (green graph) remained nearly constant from 2015 to 2021 (+16 thousand tons). However, since 2021, sales have dropped by 79 thousand tons to 449 thousand tons.

Average Prices for Paper and Board Have Declined Across All Segments in 2023 Compared to 2022

The price development across all three segments shows a similar trend. Until 2018, prices per ton slightly increased. Following that, prices slightly declined until 2020, when they saw a sharp rise up to 2022. In 2023, prices for all three segments fell back below the 2022 levels.

Paper and board for folding boxes (green graph) are the most expensive compared to graphic papers and corrugated board paper. In 2023, one ton cost an average of 1,123 euros, which is a nearly 30% increase compared to 2015.

The price for corrugated board paper (red graph) saw the largest decline in 2023 compared to 2022, dropping by around 31%. With a price of 473 euros per ton, it fell even below the 2021 level (496 euros per ton).

With an average price of 974 euros per ton, the price of graphic paper (blue graph) decreased by only 4% compared to 2022. In 2022, the price had increased by approximately 37% to 1,014 euros.

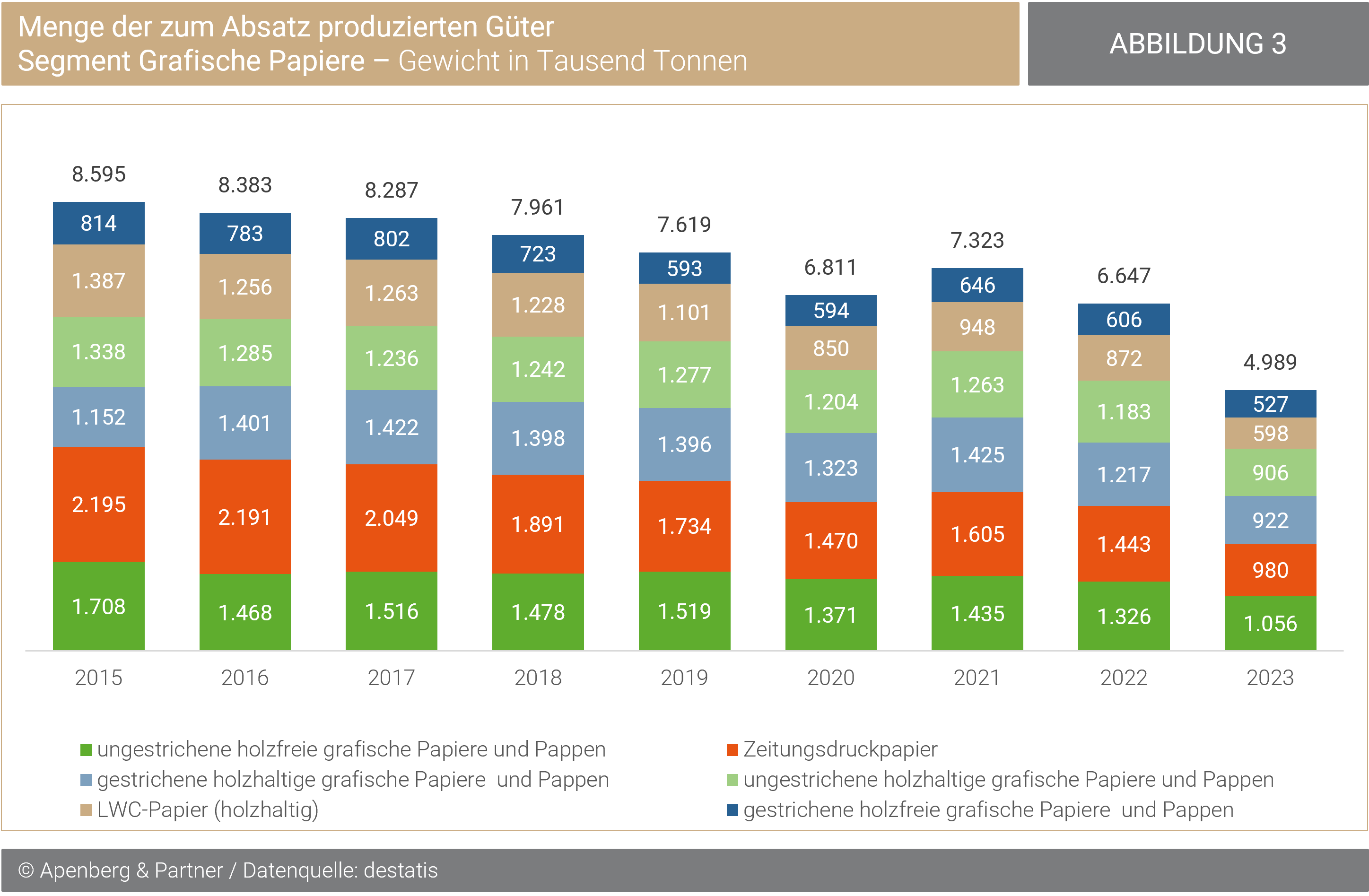

Sales of Newsprint (CAGR 15-23 – 9.6%) and LWC Paper (CAGR 15-23 -10.0%) Have Declined Sharply

Sales of graphic papers fell by a quarter from 2022 to 2023, down to just under 5.0 million tons. Particularly, the sales of papers for high-volume printed products, such as newsprint (red blocks; -33%) and LWC paper (beige blocks; -31%), have declined sharply during this period. In the previous years, both paper types had already seen a significant drop. From 2015 to 2023, newsprint sales decreased by an average of 9.6% annually, while LWC paper sales decreased by 10.0% in the same period.

Uncoated, wood-free papers (green blocks; including offset paper) had the highest sales volume in 2023, with 1.1 million tons. Wood-containing papers, coated (light blue blocks) and uncoated (light green blocks), each had a sales volume of just over 900 thousand tons, making them the third and fourth highest in sales volume in 2023. Coated, wood-free papers (blue blocks; including art paper) had the lowest sales volume in 2023, with 527 thousand tons.

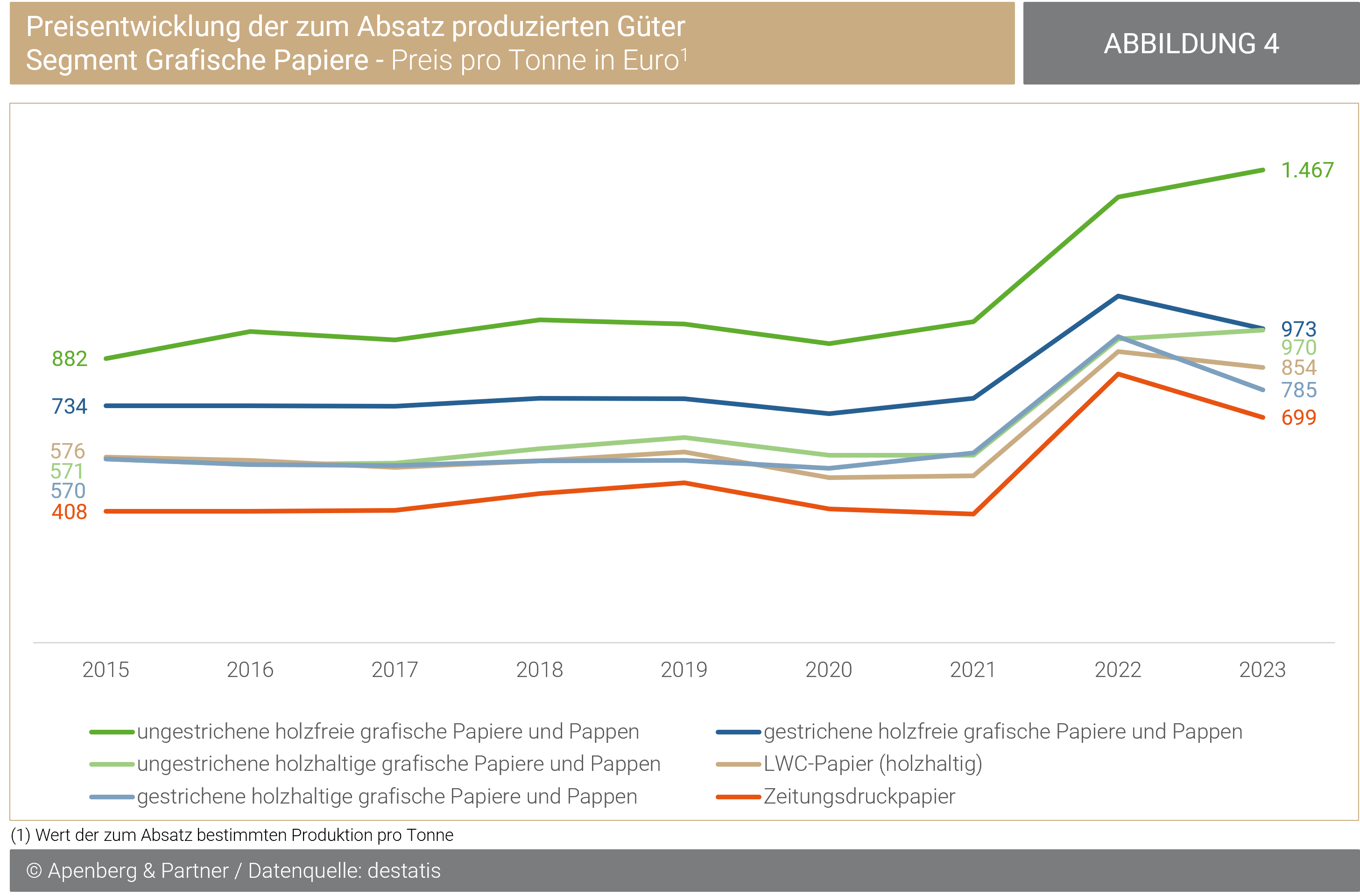

Until 2022, the price development for different graphic papers followed a similar pattern. Until 2019, prices rose slightly, then declined slightly until 2021. In 2022, prices increased by an average of 37%. In 2023, prices for newsprint, LWC paper, and coated papers fell again. The price for uncoated papers rose once more (wood-free +6.2%; wood-containing +2.8%).

The Prices of Individual Graphic Papers Were Lower in 2023 Than in 2022, with the Only Exception Being Uncoated Papers (Wood-Free and Wood-Containing), Whose Prices Continued to Rise.

Wood-free papers (coated and uncoated) are the most expensive types of paper.

In 2023, one ton of uncoated, wood-free paper cost an average of 1,467 euros. In 2015, the price was approximately 882 euros (-60%). The price for coated, wood-free paper increased by 33% from an average of 734 euros in 2015 to 973 euros in 2023. Newsprint (red graph) and LWC papers (beige graph), alongside coated, wood-containing papers (light blue graph), are the cheapest paper types.