European printers invest more than their German counterparts.

It is hardly surprising that over 90 percent of the printing industry’s annual investment is in machinery. That the proportion of companies that invested at the start of the Corona pandemic has only fallen by four percentage points, may in cotrast, be a little more surprising. Definitely noteworthy remains the fact that Germany, once amongst Europe’s leading investing printing industries, now belongs to the lower midfield of the big printing nations in terms of investment in the printing industry. The German print industry appears to be missing the opportunity to actively shape their future, instead falling into a state of reacting passively to external market forces.

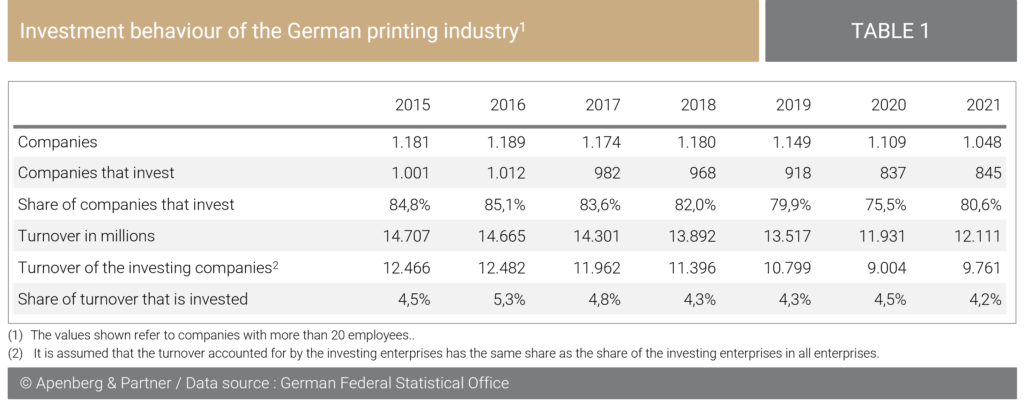

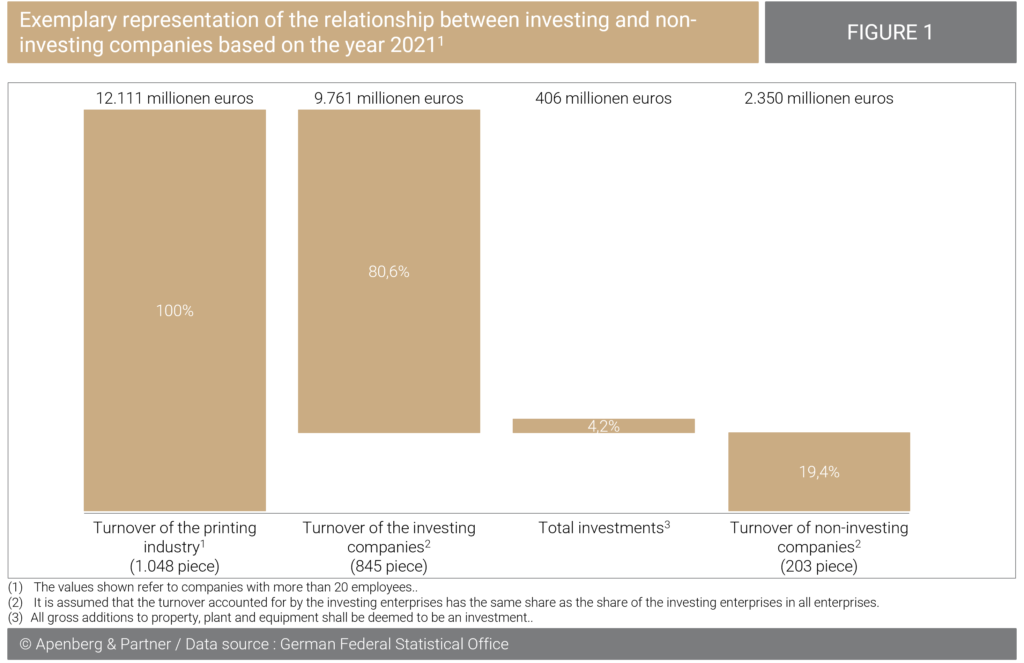

Table 1 (above) provides an overview of the German printing industry’s investment behaviour. Figure 1 (below) illustrates the relationship between turnover, the number of companies and their investment behaviour shown in Table 1, based on the year 2021. In this year 9.7 billion euros of the industry’s total turnover, of more than 12 billion euros, are accounted for by companies that have invested. The 406 million euros invested in 2021 represent a share of 4.2 per cent of the total turnover of the investing companies.

Table 1 (at the top) shows that around 80 per cent of companies in the printing industry have invested in 2019. In 2015, this figure was just under 85 per cent. Over the five-year period since, the proportion of companies that have invested in their future has declined. The number of companies in the printing industry is also declining. In the first year of the Corona pandemic (2020), just over three-quarters of companies in the printing industry invested. This is four percentage points less than in the last year before the Corona pandemic. In the second year of the pandemic, this figure rose to 80.6 per cent and was thus higher than the figure from 2019.

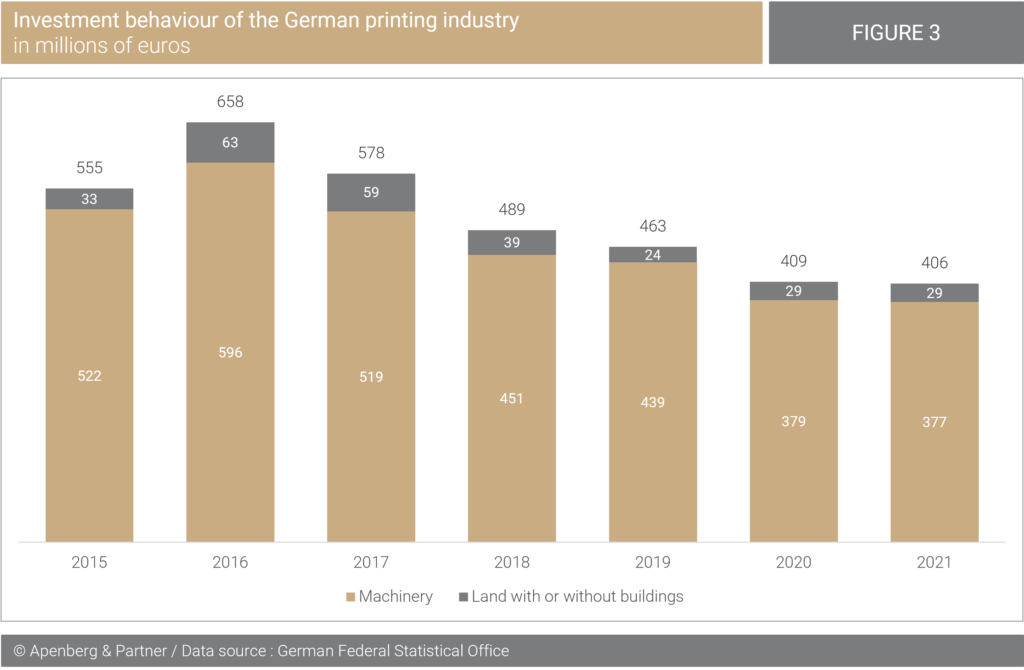

At least 90 per cent of the printing industry’s investment is spent on machinery.

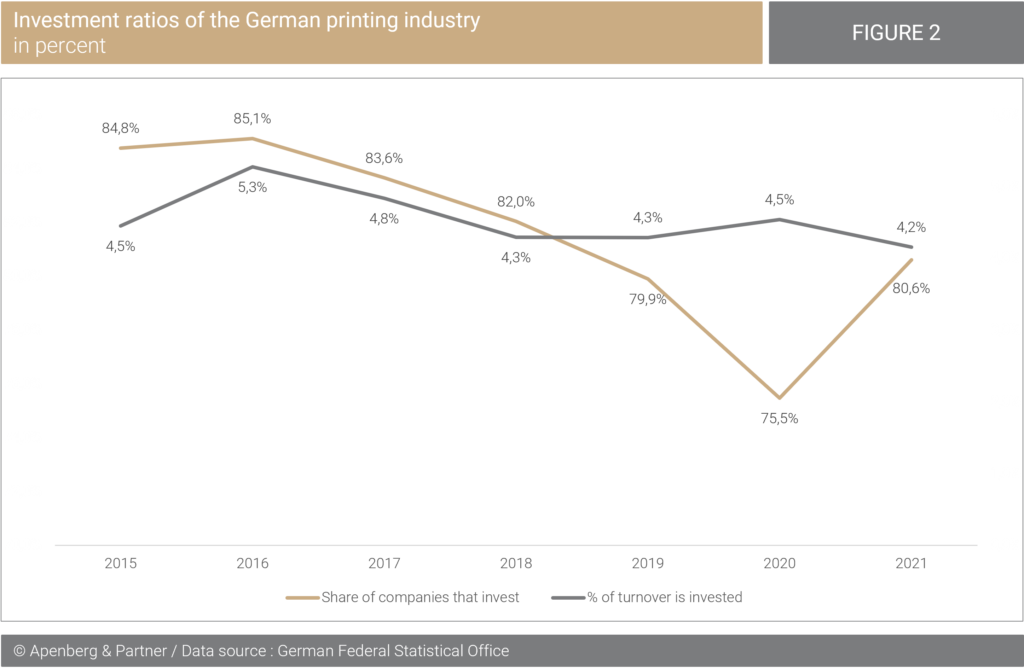

Figure 2 shows that the share of turnover spent on investments is between four and five percent. The only exception is 2016, and since 2018 this ratio has been between 4.2 and 4.5 per cent. With the onset of the pandemic in 2020, the share of companies investing varied, but the average share of turnover invested remained almost constant.

The investment volume of the German printing industry has declined by around a third since 2015.

The majority of investments in the German printing industry are used for machinery (Figure 3). Since 2015, the share of investments allocated to machinery has been at least 90 per cent. The sum of investments for such equipment has fallen from 522 million euros in 2015 to 377 million euros in 2021. This reprsents a decline of almost 30 percent. Investments in land, at 29 million euros in 2021, were about the same as in 2015 (33 million euros).

The stability of the investment versus turnover ratio suggests that these investments are mainly replacement investments as opposed to future investments. The latter are more independent of the respective economic situation, as they serve to transform companies for the future.

Prior to the pandemic, companies invested an average of around 500 thousand euros per year.

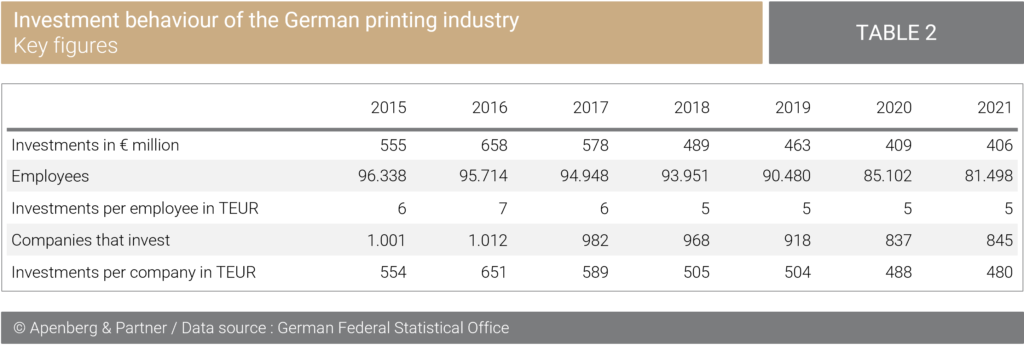

Table 2 shows two important KPIs: Investment per employee, and investment per enterprise.

In 2015, the investment per enterprise reached 554 thousand euros, and the investment per employee was six thousand euros. However, in 2019, the investment per employee was only five thousand euros and the investment per enterprise was 504 thousand euros. With the onset of the pandemic, the investment per enterprise dropped by almost 20 thousand euros to 488 thousand euros. The investments per employee were exactly the same as in the previous year at 5 kEUR.

Yet, in the era of increasing robotisation it is questionable to which extent investments per employee” remains a meaningful benchmark. Nevertheless, for the following analysis of the investment behaviour of the German printing industry, in comparison to the printing industry of individual European countries, this key figure is of importance.

Even before the start of the pandemic in 2020, a decline in overall investment is as observable as much as investments per company. This trend was reinforced in the first year of the pandemic (2020) and stabilised in 2021.

Investments of the European printing industry increased significantly compared to the German printing industry.

To place the investment behaviour of the German printing industry in the European context, it is compared to Europe’s largest printing industry (measured by turnover). For Great Britain, a country with a similarly large printing industry, there are only isolated values, forcing us to exclude Great Britain from the following consideration.

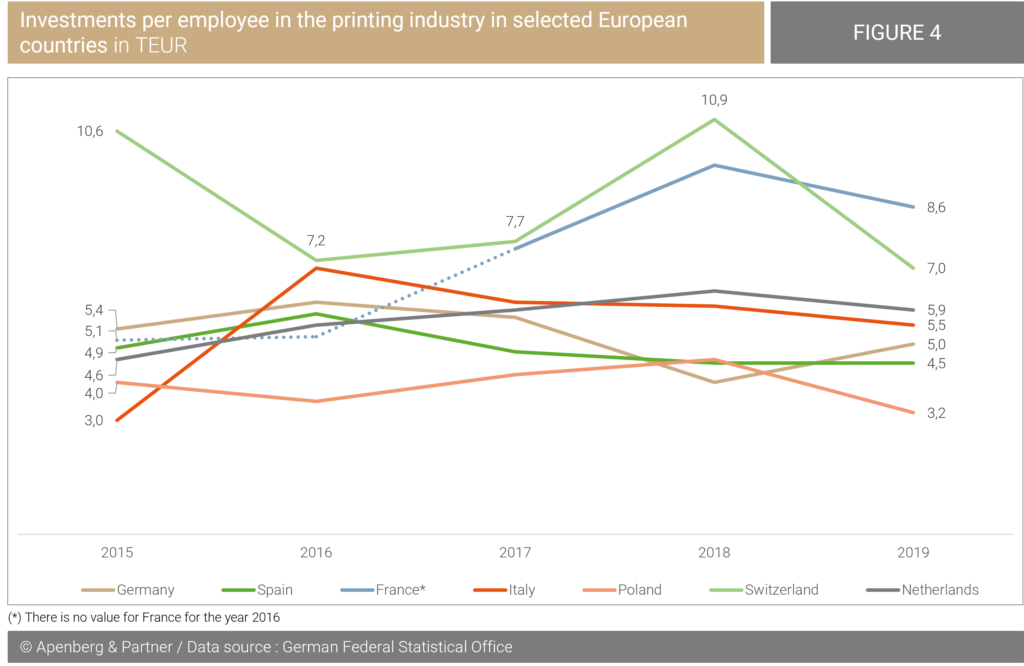

Figure 4 shows that in 2015 Germany was second place in a Europe-wide comparison, with an investment sum of 5.4 thousand euros per employee. Four years later (2019), Germany has dropped to the lower midfield with a similar investment sum per employee of 5.0 thousand euros. France, Italy and the Netherlands, which invested less per employee than Germany in 2015, have invested up to 50 percent more per employee than Germany in 2019.

In contrast to the German printing industry, investments per employee in the other major European printing nations have increased, in some cases significantly, over the course of 2015 to 2019. But the Corona pandemic may have caused a change in investment behaviour from 2020 onwards.

Investments as well as the willingness to invest will decline in the medium term.

For Germany, figures for 2020 and 2021 have already been published and they show how investment behaviour has been affected by the Corona pandemic. The lower investments by companies are explained by uncertainties in the wake of the lockdowns. During 2021, another factor that influenced investment behaviour was the increase in paper prices. Not all companies were able to pass on the increased paper prices to their customers and were thus able to generate less revenue that they could have invested. In addition, the increased paper prices and the, albeit not complete, passing on of the increased paper prices resulted in an increase in turnover. However, this increase in turnover did not generate more income that could have been invested. As a result, the share of turnover that was invested fell slightly, although the share of investing companies increased by about five percentage points. In 2022 a further burden was added to the printing industry with the start of the Ukraine war and the resulting energy crisis. The increased energy costs, as well as the uncertainty about the guarantee of supply security, will affect investment behaviour. Another indirect burden for the printing industry is that rising energy costs and the current high rate of inflation are reducing private household budgets for consumption. Demand for print products may therefore decline further. Due to the different (political) reactions of the European countries to the energy crisis, this factor will have different effects on the printing industry of each individual country. The lower the uncertainty about supply security and the lower the energy costs, the less the impact on investment behaviour will be.

The course for the future is often set in times of crisis .

Despite the multitude of factors that have a negative impact on the printing industry and investment behaviour, there are nevertheless ways for printers to be prepared for the future. With the Integrated Print Factory concept, automation and efficiency gains can reduce costs by up to 25 percent within a year, which means that the cost of transforming to an Integrated Print Factory will be recouped within a very short time. In addition, automation and efficiency gains can reduce staffing requirements. This is an aspect that should not be neglected in view of the current shortage of skilled workers and personnel. In conclusion, it remains to be said: In times of crisis, it remains prudent to examine whether investments are possible – but one should also consider whether investments are not particularly important in the current situation.